Short Term Accident

Coverage Services

Accidents can happen at any time, and being unprepared can lead to significant financial strain. Vache Healthcare offers Short Term Accident Coverage to provide you with the necessary protection against unexpected medical expenses resulting from accidents. This coverage is designed to offer peace of mind by covering various accident-related costs, ensuring that you and your loved ones are well-protected. In this guide, we will explore the benefits, features, and importance of short-term accident coverage and how Vache Healthcare can assist you in safeguarding your health and finances.

Understanding Short Term Accident Coverage

Short Term Accident Coverage is a type of insurance that provides financial protection for medical expenses incurred due to accidents. This coverage is particularly beneficial for individuals who need temporary insurance to cover unexpected accidents, without committing to a long-term policy. It can include expenses such as emergency room visits, hospitalization, surgeries, and other accident-related medical treatments.

The Importance of Accident Insurance Coverage

Accidents can result in substantial medical bills and lost income, making it essential to have adequate accident insurance coverage. Here are some reasons why short-term accident coverage is important:

Immediate Financial Protection

Accidents often lead to unexpected expenses. Short term accident coverage ensures that you are financially protected immediately following an accident, covering medical bills and other related costs.

Affordable Premiums

Short term accident coverage typically has lower premiums compared to long-term policies, making it an affordable option for those who need temporary protection.

Comprehensive Coverage

Despite being short-term, this coverage provides comprehensive protection, including emergency treatments, hospital stays, and surgeries.

Peace of Mind

Knowing that you have accident coverage can provide peace of mind, allowing you to focus on recovery without worrying about the financial implications.

Features of Vache Healthcare's Short Term Accident Coverage

Vache Healthcare’s Short Term Accident Coverage is designed to meet the diverse needs of our clients. Here are some key features of our coverage:

Comprehensive Accident Insurance Coverage:

Our plans offer extensive coverage for various accident-related medical expenses, ensuring that you receive the necessary care without financial stress.

Our dedicated support team is available around the clock to assist you with any questions or concerns regarding your coverage.

We provide a variety of plans to suit different needs and budgets. Whether you need short term accident coverage for a specific period or a more comprehensive option, Vache Healthcare has solutions for you.

The enrollment process is straightforward, allowing you to get coverage quickly and efficiently.

Our short term accident coverage plans are competitively priced, ensuring that you get the best value for your money.

How Short Term Accident Coverage Works

Understanding how short term accident coverage works can help you make an informed decision about your healthcare needs. Here’s a step-by-step breakdown of the process with Vache Healthcare:

- Our team works with you to assess your current health insurance plan and identify any gaps in coverage that may require additional protection.

Based on your needs and budget, we help you select the best accident coverage health insurance plan or a more comprehensive option.

Once you have chosen a plan, our team guides you through the enrollment process, ensuring that all necessary paperwork is completed accurately and efficiently.

After enrollment, your short term accident coverage becomes active, providing you with the added protection you need.

In the event of an accident, you can file a claim with Vache Healthcare. Our team processes your claim promptly, ensuring that you receive your benefits quickly.

Choosing the Best Short Term Accident Coverage

Selecting the right short-term accident coverage plan is crucial for ensuring that you and your family are fully protected. Here are some tips to help you choose the best personal accident insurance coverage:

Start by reviewing your existing health insurance plan to identify any gaps in coverage. This will help you determine what additional protection you need.

Consider Your Health Needs: Think about your health history and any potential future needs. If you are involved in activities that increase your risk of accidents, ensure that your coverage includes these scenarios.

Don’t settle for the first plan you come across. Compare different plans and providers to find the best short term accident coverage that suits your needs and budget.

Look for plans that offer flexibility in terms of coverage options and premiums. Vache Healthcare provides a range of plans that can be tailored to your specific requirements.

Make sure you understand the terms and conditions of the plan, including any exclusions or limitations. This will help you avoid any surprises when it comes time to file a claim.

The Benefits of Personal Accident Insurance Coverage

Personal accident insurance coverage offers numerous benefits, including:

- Financial Security

- Supplemental Income

- No Network Restrictions

- Coverage for a Wide Range of Expenses

This coverage provides financial security by covering medical expenses resulting from accidents, helping you avoid debt and financial stress.

Some plans provide benefits that can be used for any purpose, such as covering lost income or paying for non-medical expenses related to the accident.

Personal accident insurance typically does not have network restrictions, allowing you to receive care from any hospital or healthcare provider.

Personal accident insurance can cover various expenses, including hospitalization, surgeries, emergency treatments, and rehabilitation.

Why Choose Vache Healthcare for Your Short Term Accident Coverage?

Vache Healthcare is committed to providing top-notch healthcare solutions that meet the needs of our clients. Here’s why you should choose us for your short term accident coverage:

- Expertise and Experience: With years of experience in the healthcare industry, Vache Healthcare has the knowledge and expertise to provide you with the best accident insurance coverage plans.

- Customer-Centric Approach: Our clients are at the heart of everything we do. We work closely with you to understand your needs and provide personalized solutions.

- Comprehensive Plans: Our short term accident coverage plans are designed to offer extensive protection, covering a wide range of accident-related expenses.

- Affordable Options: We believe that quality healthcare should be accessible to everyone. Our plans are competitively priced to ensure that you get the best value for your money.

- Supportive Team: Our dedicated support team is always ready to assist you with any questions or concerns, providing you with the support you need every step of the way.

Our Reviews

Trustindex verifies that the original source of the review is Google. Coleen is so knowledgable, professional, kind, and a great resource!! She made the impossible task of finding quality and affordable health insurance so easy. Can't recommend her enough.Trustindex verifies that the original source of the review is Google. Coleen made a huge difference in my company’s offer for health insurance for our full time employees. She takes time to personally assist each employee to find the best fit for insurance. Highly recommend!Trustindex verifies that the original source of the review is Google. Coleen was amazing to work with! I had a bqd experience with an agent before meeting with coleen and i was kind of wary but coleen made everything smooth and easyTrustindex verifies that the original source of the review is Google. Coleen has been so helpful in getting me new health insurance. I cannot recommend her enough!!Trustindex verifies that the original source of the review is Google. Coleen is the best of the best! The insurance process can be daunting but she does a fantastic job at educating and guiding you through each step. She is kind, informative, and knowledgeable. I highly recommend working with Coleen.Trustindex verifies that the original source of the review is Google. Coleen was always so quick to respond when I had questions and so helpful!Trustindex verifies that the original source of the review is Google. Coleen is fantastic! She made the whole buying insurance which to me is extremely complicated not feel that way. I am a travel nurse that wanted longer time between contracts and Coleen made every step of the way incredibly simplified and easy to understand. On top of the ease she provides excellent customer service the pure availability of being able to text her to ask questions about my policy whenever one came up was impeccable! It’s like you are talking to your own personal insurance friend she is so easy to talk to and personable. I have and will continue to recommend her to anyone that needs health insurance!!!!Trustindex verifies that the original source of the review is Google. Coleen was great to work with. She set me up with a perfect plan for me in less than an hour. She’s been available to text with questions and answers super quick.Trustindex verifies that the original source of the review is Google. Coleen was excellent with keeping in touch and keeping me one step ahead during this whole process. She is very knowledgeable in her field and she is VERY easy to work with!! I would definitely recommend Coleen for any of your health insurance needs. I was new to the private health insurance world and Coleen made everything very easy for me to understand and was amazing with answering all of my questions (no matter how silly, crazy, or just a garbled mess they were when I tried to ask them). Please know that I am not affiliated with Coleen in any way (except for buying health insurance through her 😁), I am just a very happy customer who was overly pleased with the service she provided me!

Frequently Asked Questions

What is short term accident coverage?

Short term accident coverage is a type of insurance that provides financial protection for medical expenses incurred due to accidents. It offers temporary coverage without the commitment of a long-term policy.

How does short term accident coverage work?

Short term accident coverage works by providing benefits for accident-related medical expenses. You can file a claim with Vache Healthcare, and our team will process it promptly, ensuring you receive your benefits quickly.

Why do I need short term accident coverage?

Short term accident coverage is essential for covering unexpected medical expenses resulting from accidents. It offers immediate financial protection, affordable premiums, and comprehensive coverage.

How do I choose the best personal accident insurance coverage?

To choose the best personal accident insurance coverage, evaluate your current coverage, consider your health needs, compare plans, check for flexibility, and read the fine print to ensure the plan meets your requirements.

Conclusion

In conclusion, short term accident coverage from Vache Healthcare offers comprehensive protection and peace of mind for individuals and families. By understanding the benefits and how to choose the right plan, you can ensure that you are fully protected against unexpected medical expenses. Trust Vache Healthcare to provide you with the best solutions for your healthcare needs.

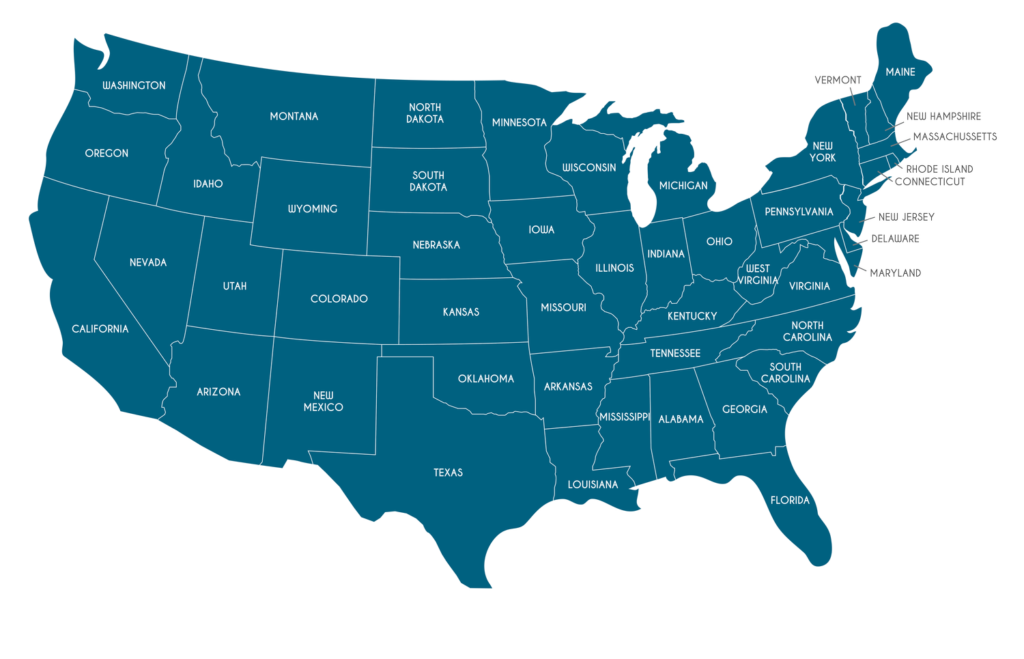

Proudly offering short term accident coverage insurance in the following states

Oklahoma

Alabama

Arkansas

Colorado

Florida

Georgia

Iowa

Illinois

Indiana

Kentucky

Kansas

Los Angeles

Michigan

Missouri

Massachusetts

Montana

North Carolina

Nebraska

Nevada

Ohio

South Carolina

South Dakota

Tennessee

Texas

Utah

Virginia

Wisconsin

West Virginia

Wyoming